Nitinol Strip Market Trends Every Buyer Should Know

2025-10-27 20:02:22

The nitinol strip market has experienced unprecedented growth over the past decade, driven by expanding applications in medical devices, aerospace, and industrial sectors. Understanding the latest market trends in nitinol strip procurement is essential for buyers seeking to make informed decisions in this rapidly evolving landscape. With global nitinol market projections reaching $36.69 billion by 2030 and growing at a compound annual growth rate (CAGR) of 8%, the nitinol strip segment represents a crucial component of this expansion.

Market Growth Dynamics and Demand Patterns

Rising Applications Across Multiple Industries

The nitinol strip market demonstrates remarkable versatility, with applications expanding far beyond traditional medical device manufacturing. Medical device companies increasingly rely on nitinol strip materials for minimally invasive surgical instruments, cardiovascular stents, and orthodontic applications. The superelastic properties of nitinol strip make it ideal for guidewires, where consistent flexibility and shape recovery are paramount. Industrial applications have also embraced nitinol strip technology, particularly in actuators, sensors, and aerospace components where precise temperature-controlled activation is required.Manufacturing sectors are increasingly adopting nitinol strip solutions for their unique combination of biocompatibility, corrosion resistance, and shape memory characteristics. The aerospace industry utilizes nitinol strip components in wing morphing technologies and vibration damping systems, while the automotive sector incorporates these materials in adaptive suspension systems and thermal management applications. Consumer electronics manufacturers have begun integrating nitinol strip elements in foldable device mechanisms and compact actuator systems, demonstrating the material's adaptability across diverse technological applications.

Medical Device Market Expansion Driving Demand

Healthcare technology advancement continues to be the primary driver of nitinol strip demand, with the medical devices market projected to reach $38.6 billion by 2031. The increasing preference for minimally invasive procedures has created substantial opportunities for nitinol strip manufacturers. Cardiovascular applications represent the largest segment, accounting for significant market share due to the material's excellent fatigue resistance and biocompatibility. Surgical instrument manufacturers increasingly specify nitinol strip materials for their ability to maintain consistent performance under repeated sterilization cycles.Orthodontic applications have emerged as a rapidly growing segment, with nitinol strip wires providing continuous gentle forces for tooth movement. The material's superelastic properties allow for simplified treatment protocols and improved patient comfort compared to traditional stainless steel alternatives. Orthopedic device manufacturers are exploring innovative applications for nitinol strip components in spinal fusion devices, bone plates, and joint replacement systems, leveraging the material's unique mechanical properties to enhance patient outcomes and reduce recovery times.

Technological Advancements in Processing Methods

Advanced manufacturing techniques have significantly improved nitinol strip quality and consistency, enabling new applications and market segments. Cold working processes have been refined to achieve precise mechanical properties, while heat treatment protocols ensure optimal transformation temperatures for specific applications. Surface finishing technologies have evolved to provide enhanced biocompatibility and corrosion resistance, meeting stringent regulatory requirements for medical device applications.Quality control systems incorporating advanced testing methodologies ensure consistent nitinol strip properties across production batches. Non-destructive testing techniques, including differential scanning calorimetry and mechanical testing protocols, verify transformation temperatures and mechanical properties before shipment. These technological improvements have reduced material variability and enhanced reliability, making nitinol strip materials more attractive to manufacturers requiring consistent performance characteristics across large production volumes.

Supply Chain Considerations and Material Sourcing

Raw Material Availability and Price Fluctuations

Nitinol strip manufacturing depends on consistent supplies of high-purity nickel and titanium, with market prices subject to global commodity fluctuations. The nickel titanium alloy composition, typically containing 54.5-56.5% nickel with titanium balance, requires precise control over raw material quality to achieve desired transformation temperatures and mechanical properties. Supply chain disruptions can significantly impact nitinol strip availability, making supplier relationships and inventory management crucial considerations for buyers.Strategic sourcing initiatives have become increasingly important as demand for nitinol strip materials continues to grow. Manufacturers are establishing long-term supply agreements with raw material suppliers to ensure consistent availability and price stability. Quality certifications, including ISO9001, SGS, and TUV compliance, provide assurance of material consistency and traceability throughout the supply chain. Buyers should evaluate supplier capabilities beyond price considerations, including technical support, quality systems, and supply chain resilience.

Geographic Manufacturing Distribution

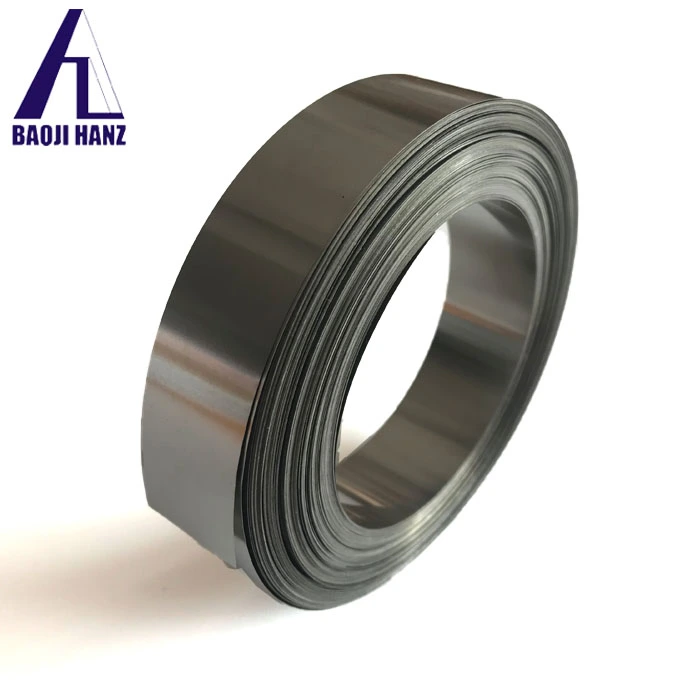

Global nitinol strip manufacturing is concentrated in specific regions with advanced metallurgical capabilities and quality control infrastructure. China has emerged as a significant producer of nitinol strip materials, offering competitive pricing while maintaining quality standards. Manufacturing facilities in Baoji, Shaanxi, China, have developed specialized expertise in nitinol processing, providing comprehensive solutions from raw material preparation to finished strip products.Regional manufacturing capabilities offer advantages in terms of shipping costs, lead times, and technical support. Proximity to end-user markets enables faster response times for custom specifications and emergency requirements. Local manufacturing also provides opportunities for face-to-face technical consultations and quality audits, building stronger partnerships between suppliers and buyers. However, buyers must carefully evaluate manufacturing capabilities, quality systems, and certification compliance when selecting regional suppliers.

Inventory Management Strategies

Effective inventory management has become increasingly critical as nitinol strip applications expand across multiple industries. Just-in-time delivery requirements from medical device manufacturers necessitate reliable supply chain performance and accurate demand forecasting. Minimum order quantities, typically starting at 2 kilograms for specialized nitinol strip specifications, require careful planning to balance inventory costs with availability requirements.Strategic inventory positioning involves maintaining adequate safety stock while minimizing carrying costs and obsolescence risks. Suppliers offering flexible packaging options, including coiled or spooled configurations, provide buyers with enhanced handling and processing efficiency. Long-term supply agreements often include inventory management services, where suppliers maintain consignment stock at customer locations to ensure immediate availability while reducing working capital requirements.

Quality Standards and Specification Requirements

Material Property Verification Methods

Comprehensive quality control protocols ensure nitinol strip materials meet increasingly stringent application requirements. Transformation temperature verification through differential scanning calorimetry confirms austenite finish (Af) temperatures ranging from -20°C to 100°C, depending on application requirements. Mechanical testing protocols evaluate superelastic properties, including loading plateaus, unloading plateaus, and residual strain characteristics essential for device performance.Chemical composition analysis verifies nickel content within specified ranges, typically 54.5-56.5%, ensuring consistent transformation behavior and mechanical properties. Surface quality inspection examines finish characteristics, whether bright or black oxide, to meet specific application requirements. Dimensional verification confirms thickness tolerances from 0.1mm to 0.8mm and width specifications from 0.2mm to 3.13mm, ensuring compatibility with manufacturing processes and final device requirements.

Regulatory Compliance and Certification

Medical device applications require comprehensive regulatory compliance documentation, including material certifications, biocompatibility testing, and process validation records. ISO13485 quality management systems ensure consistent production methods and traceability throughout the manufacturing process. FDA and CE marking requirements for medical device materials necessitate extensive documentation and validation testing to demonstrate safety and efficacy.Quality management systems incorporating risk management principles ensure continuous improvement and process control. Supplier audits and certification maintenance require ongoing compliance monitoring and documentation updates. Regulatory changes in key markets can significantly impact material requirements, making supplier expertise in regulatory affairs increasingly valuable for buyers navigating complex compliance landscapes.

Custom Specification Capabilities

Growing demand for specialized nitinol strip applications has increased the importance of custom specification capabilities. OEM services enable manufacturers to develop materials with specific transformation temperatures, mechanical properties, and dimensional characteristics tailored to unique application requirements. Technical consultation services help buyers optimize material selection for specific performance criteria, cost objectives, and manufacturing processes.Custom alloy compositions extending beyond standard nickel-titanium formulations offer enhanced properties for specialized applications. Heat treatment protocols can be modified to achieve specific transformation temperature ranges and mechanical characteristics. Surface treatment options, including electropolishing, passivation, and coating applications, provide enhanced biocompatibility and corrosion resistance for demanding environments.

Conclusion

The nitinol strip market presents significant opportunities for buyers across medical device, aerospace, and industrial sectors. Understanding market trends, supply chain dynamics, and quality requirements enables informed procurement decisions in this rapidly growing market. With global demand projected to continue expanding at robust growth rates, establishing reliable supplier relationships and maintaining technical expertise becomes increasingly critical for success.

As a leading China nitinol strip manufacturer, Baoji Hanz Metal Material Co., Ltd. offers comprehensive solutions with seven years of expertise in Nitinol Shape Memory Alloy, Superelastic Nitinol Alloy, and Nickel Titanium Alloy production. Our direct supply and cost advantages ensure competitive pricing, while fast delivery from large stock inventories meets urgent requirements. Whether you need a China nitinol strip supplier for standard specifications or customized nitinol strip solutions, our OEM services provide tailored solutions for specific project requirements. Contact us at baojihanz-niti@hanztech.cn for nitinol strip price quotations, nitinol strip for sale inquiries, and nitinol strip free sample requests to discover how our China nitinol strip wholesale capabilities can support your projects.

References

1. "Nitinol Medical Devices Market Analysis and Growth Projections" - Coherent Market Insights Research Team, Healthcare Materials Analysis Division

2. "Shape Memory Alloys in Industrial Applications: Market Trends and Technological Developments" - Dr. Sarah Chen, Materials Science Institute, Advanced Metallurgy Research

3. "Global Nitinol Market Dynamics and Supply Chain Analysis" - International Materials Research Foundation, Market Analysis Department

4. "Quality Standards and Regulatory Requirements for Nitinol Medical Device Materials" - Medical Device Materials Standards Committee, Regulatory Compliance Research Group